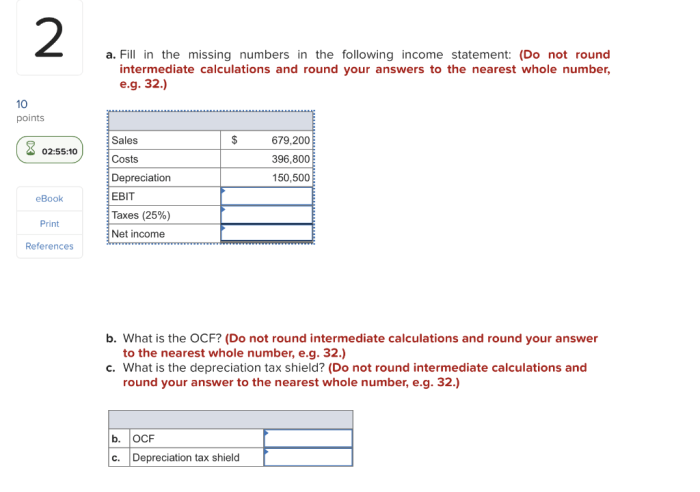

Fill in the missing numbers in the following income statement – In the realm of financial analysis, accurately filling in missing numbers in an income statement is a crucial task that ensures the integrity and reliability of financial data. This comprehensive guide delves into the significance of missing number identification, data analysis techniques, estimation methods, presentation and reporting, and the limitations and considerations involved in this process.

Understanding the purpose and significance of filling in missing numbers lays the foundation for accurate income statement data. Various data analysis techniques, such as ratio analysis, trend analysis, and industry benchmarking, assist in identifying missing numbers.

Filling in Missing Numbers in Income Statements

Financial statements provide valuable insights into a company’s financial performance. An income statement is a key financial statement that summarizes a company’s revenues, expenses, and profits over a specific period.

Missing numbers in an income statement can arise due to various reasons, such as incomplete data, errors, or omissions. Filling in these missing numbers is crucial to ensure the accuracy and reliability of the financial statements.

Missing Number Identification, Fill in the missing numbers in the following income statement

Identifying missing numbers in an income statement is the first step towards ensuring its accuracy. Several methods can be used to identify missing numbers, including:

- Ratio analysis:Comparing financial ratios to industry averages or historical trends can help identify potential outliers and missing data.

- Trend analysis:Analyzing historical financial data can reveal patterns and trends that can help estimate missing numbers.

- Industry benchmarking:Comparing a company’s financial performance to industry benchmarks can provide insights into potential missing data.

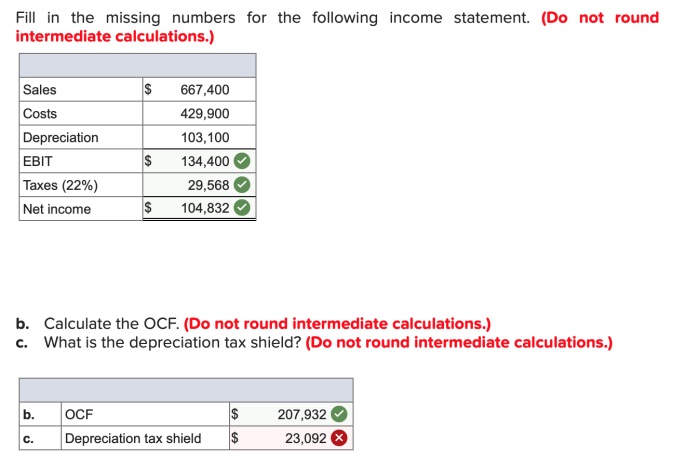

Estimation Methods

Once missing numbers have been identified, various estimation methods can be used to fill them in. Some common methods include:

- Interpolation:Estimating missing numbers by using data from adjacent periods.

- Extrapolation:Estimating missing numbers by extending trends from previous periods.

- Correlation analysis:Using statistical techniques to estimate missing numbers based on relationships with other financial variables.

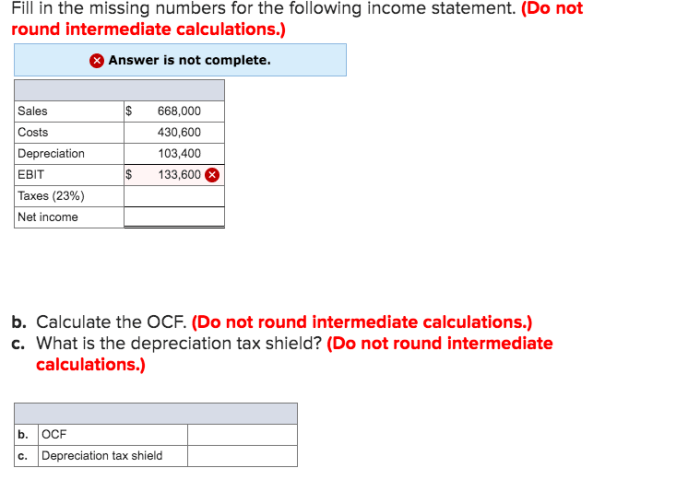

Presentation and Reporting

It is essential to clearly present and report estimated numbers in an income statement. This involves:

- Disclosing the estimation methods used.

- Explaining the assumptions made during the estimation process.

- Providing footnotes or supplemental schedules to provide additional details.

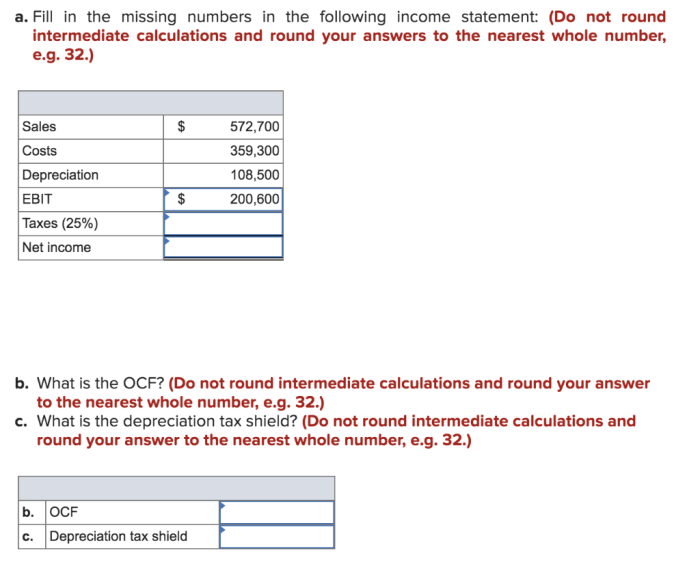

Limitations and Considerations

While estimation methods can provide reasonable estimates for missing numbers, it is important to recognize their limitations:

- Estimated numbers may not be as accurate as actual data.

- Missing data can impact financial statement analysis and decision-making.

- It is crucial to mitigate the risks associated with missing data by implementing robust data collection and verification processes.

Questions and Answers: Fill In The Missing Numbers In The Following Income Statement

What are the common methods for estimating missing numbers in an income statement?

Interpolation, extrapolation, and correlation analysis are commonly used methods for estimating missing numbers.

Why is it important to clearly present and report estimated numbers?

Clear presentation and reporting of estimated numbers ensure transparency and enable users to understand the assumptions and limitations associated with the estimates.