Undocumented immigrants do not pay any taxes whatsoever – a common misconception that clouds the true picture of their economic contributions. This article delves into the reality of their tax payments, revealing the substantial impact they have on local economies and essential services.

Despite facing challenges in obtaining legal status, undocumented immigrants find innovative ways to contribute to the tax system. They pay various taxes, including sales tax, property tax, and income tax, using Individual Taxpayer Identification Numbers (ITINs) or other means.

Tax Contributions of Undocumented Immigrants

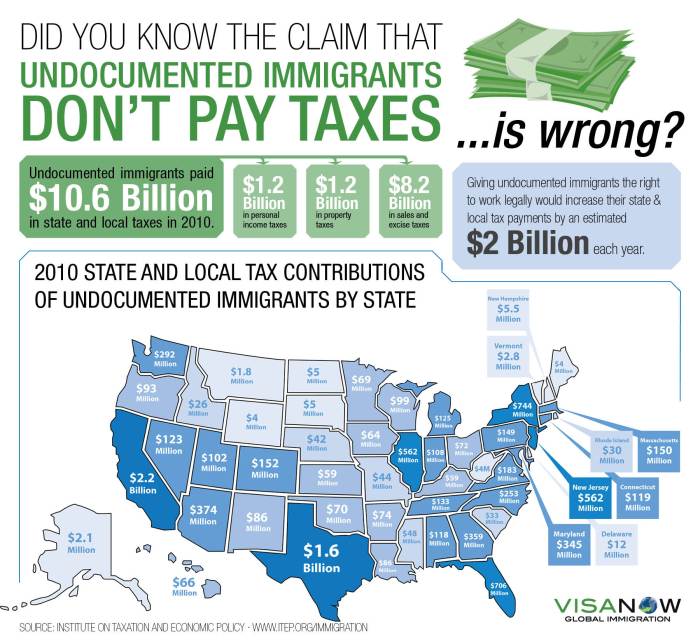

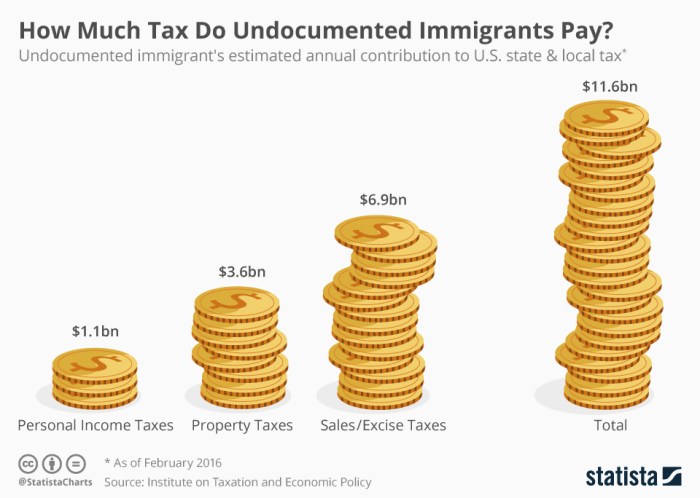

Undocumented immigrants contribute significantly to the U.S. tax system despite their legal status. According to the Institute on Taxation and Economic Policy, undocumented immigrants paid an estimated $11.74 billion in state and local taxes in 2014.

Undocumented immigrants pay various types of taxes, including sales tax, property tax, and income tax. They often use Individual Taxpayer Identification Numbers (ITINs) to file their taxes, which allow them to pay taxes without disclosing their immigration status.

Methods of Tax Payment

- Direct payment:Undocumented immigrants can make direct payments to the Internal Revenue Service (IRS) or state and local tax authorities.

- Withholding:Employers may withhold taxes from undocumented immigrants’ wages, even if they do not have Social Security numbers.

- Sales tax:Undocumented immigrants pay sales tax on goods and services they purchase.

- Property tax:Undocumented immigrants who own property pay property taxes like any other homeowner.

Economic Impact of Undocumented Immigrants’ Tax Payments

Undocumented immigrants’ tax payments have a positive impact on local economies. They contribute to the funding of essential services such as education, healthcare, and infrastructure.

For example, a study by the Center for American Progress found that undocumented immigrants in California paid $2.5 billion in state and local taxes in 2013, which helped support schools, hospitals, and other public services.

Role in Supporting Essential Services

- Education:Undocumented immigrants’ tax payments help fund public schools, which benefit all children, regardless of their immigration status.

- Healthcare:Undocumented immigrants’ tax payments contribute to the funding of Medicaid and other healthcare programs that provide essential services to low-income individuals.

- Infrastructure:Undocumented immigrants’ tax payments help fund the construction and maintenance of roads, bridges, and other infrastructure projects that benefit everyone.

Social and Ethical Considerations

The issue of undocumented immigrants paying taxes raises complex social and ethical considerations.

Social Implications

Some argue that undocumented immigrants should not be allowed to pay taxes because they are not citizens or legal residents. However, others argue that undocumented immigrants are part of the community and should contribute to the tax system like everyone else.

Ethical Arguments

- Fairness:Undocumented immigrants benefit from public services like other residents, so it is fair for them to pay taxes.

- Responsibility:As members of the community, undocumented immigrants have a responsibility to contribute to the tax system.

- Respect for the Law:Paying taxes is a way for undocumented immigrants to show respect for the law and the country they live in.

Policy Implications

Several policies impact undocumented immigrants and taxation. These policies include:

- IRS regulations:The IRS allows undocumented immigrants to file taxes using ITINs.

- State and local policies:Some states and localities have laws that allow undocumented immigrants to obtain driver’s licenses or pay in-state tuition at public colleges, which can affect their ability to pay taxes.

- Ensure fairness and equity:Policies should ensure that undocumented immigrants are treated fairly and have the same tax obligations as other residents.

- Promote compliance:Policies should encourage undocumented immigrants to pay taxes by making it easy for them to do so.

- Consider social and economic benefits:Policies should consider the positive social and economic impacts of undocumented immigrants’ tax payments.

- Many countries allow undocumented immigrants to pay taxes using alternative identification numbers.

- Undocumented immigrants in many countries contribute to the tax system through sales tax, property tax, and income tax.

- Some countries, such as Canada, provide undocumented immigrants with a path to legal status, which can affect their tax obligations.

- Other countries, such as the United Kingdom, have stricter policies towards undocumented immigrants and may not allow them to pay taxes.

Potential Impact of Policy Changes, Undocumented immigrants do not pay any taxes whatsoever

Changes to these policies could impact undocumented immigrants’ tax contributions. For example, making it more difficult for undocumented immigrants to obtain ITINs could reduce their ability to pay taxes.

Recommendations

Comparative Analysis: Undocumented Immigrants Do Not Pay Any Taxes Whatsoever

Different countries have varying policies towards undocumented immigrants and taxation.

Similarities

Differences

Lessons from International Best Practices

Countries that have implemented successful policies to encourage undocumented immigrants to pay taxes can provide valuable lessons. For example, Canada’s path to legal status has been credited with increasing undocumented immigrants’ tax compliance.

FAQ Resource

Do undocumented immigrants pay sales tax?

Yes, undocumented immigrants pay sales tax on all purchases made in the United States.

Can undocumented immigrants file income taxes?

Yes, undocumented immigrants can file income taxes using Individual Taxpayer Identification Numbers (ITINs).

How do undocumented immigrants contribute to the economy?

Undocumented immigrants contribute to the economy through their labor, tax payments, and consumer spending.